Liquidity management

MuniFin’s primary objective in liquidity management is to optimize an adequate liquidity buffer and allocation in order to always ensure business continuity. The liquidity buffer must cover liquidity requirements for at least one year ahead, without additional new funding. Liquidity risk is constantly measured using forward looking liquidity metrics, and steered accordingly. Furthermore, Treasury manages the daily allocation of liquidity and cash flows to meet intra-day liquidity requirements.

Secondary objective in liquidity management is to generate sufficient income while respecting the limits in MuniFin’s Risk Appetite Framework. The framework includes the management of market-, credit- and ESG risks.

Liquidity portfolio is subject to active management and its strategic objectives are defined in the annual Liquidity & Funding Plan. Portfolio size varies over time depending on daily cash flows and prevailing risk appetite.

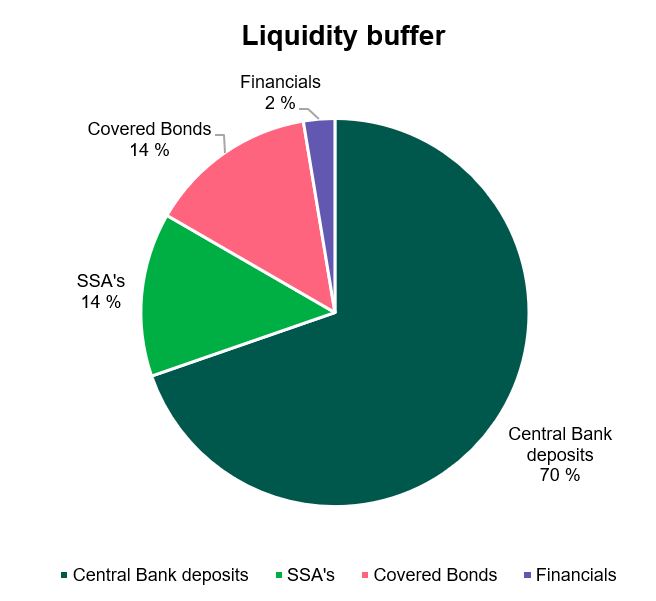

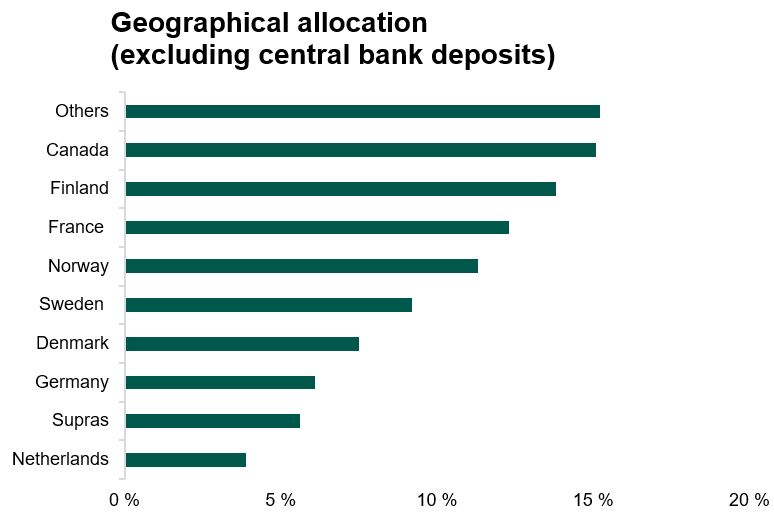

At the end of 2022, MuniFin’s total liquidity amounted to EUR 11.6 bln, of which EUR 8.1 bln were overnight central bank deposits, and EUR 3.5 bln security investments with longer maturities.

Part of MuniFin’s long-term assets are invested in sustainable investments, i.e. green bonds and social bonds. These thematic investments stood at EUR 498 mln at the end of 2022. To learn more about our sustainable path and Sustainable Investment Framework, please read here.