On Tuesday 16 April, MuniFin issued a new 3-year USD 1 billion benchmark with initial price guidance of MS+33 basis points. Investor demand continued to grow throughout the morning and books closed a few hours later in excess of USD 1.5 billion.

The bond was priced at MS +33 basis points, consistent with the initial guidance, with a coupon of 4.875%, a reoffer price of 99.708% and a re-offer yield of 4.981%. It carries a spread of 18 basis points over the CT 3 4.500% due 15 April 2027.

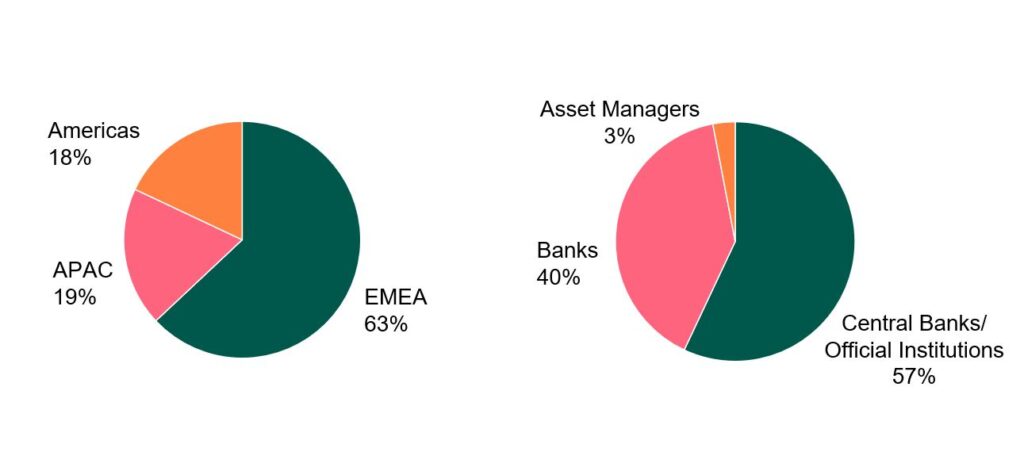

The final orderbook was geographically diverse with 48 high-quality accounts participating. Central banks took 57% of the allocations, followed by Banks and bank treasuries (40%), and Asset Managers, taking the remaining 3%.

“Investor demand started to accumulate after a moderate start, eventually reaching over USD 1.5 billion. We were particularly pleased with the quality of the final orderbook, as majority was allocated to central banks and official institutions. We have now successfully secured a little less than half of our funding target for the year”, says Analyst Aaro Koski.

After this transaction, MuniFin has now completed EUR 4.5 billion of its EUR 9–10 billion funding programme for 2024.

Distribution

Transaction details

| Issuer: | Municipality Finance Plc (“MuniFin”) |

| Rating: | Aa1 / AA+ (Moody’s/S&P – both stable) |

| Issue Size: | USD 1 billion |

| Payment Date: | 23 April 2024 (T+5) |

| Maturity Date: | 23 April 2027 |

| Coupon: | 4.875% |

| Re-offer Price: | 99.667% |

| Re-offer Yield: | 4.996% |

| Re-offer vs. Mid Swaps: | +33bps |

| Re-offer vs. Benchmark: | CT 3 4.500% due 15 April 2027 +18bps |

| ISIN: | XS2807531657 / US62630CEL19 |

| Lead Managers | J.P. Morgan SE, Morgan Stanley Co & International PLC, Nomura Financial Products Europe GmbH, TD Global Finance unlimited company |

Comments from Lead Managers

Ben Adubi, Managing Director, Head of SSA, Morgan Stanley:

“Another successful outing in the USD market for MuniFin following their strong 5-year issued earlier this year. Taking advantage of the favourable move in swap spreads and recent sell-off in rates, the deal amassed a high-quality and granular orderbook with 57% of allocations to CB/OIs, which is a testament to the strength of MuniFin’s credit quality and their opportunistic funding strategy. Congratulations to the MuniFin team on a stellar start to Q2, following on from an impressive start to the year, Morgan Stanley is delighted to have been involved!”

Mark Yeomans, Managing Director, Nomura:

“Yet another strong USD outing from MuniFin; with the new 3-year benchmark complementing the 5-year issued earlier in January. MuniFin took advantage of the global back up in rates to deliver another record 4.875% coupon for investors, as witnessed in their previous 3-year from last October. The quality of the orderbook is a testament to the investor following that MuniFin enjoys as a safe haven asset and the diligent investor outreach of the entire funding team. Nomura were delighted to be a part of such an important transaction.”

Ioannis Rallis, Executive Director, Head of SSA DCM, J.P. Morgan:

“Congratulations to the MuniFin team for printing another solid USD benchmark this year! Despite uncertain geopolitical backdrop and busy pipeline in the week, MuniFin was successfully able to achieve its tightest spread vs SOFR MS (+33bps) for a MuniFin USD 3-year benchmark. The high quality of the orderbook reflected in the 57% allocation to CB/OIs is a testament to investor confidence in MuniFin’s name. We are delighted to be involved in this transaction.”

Laura Quinn, Managing Director, Global Co-Head of SSA and Head of Dublin Debt Capital Markets:

“Congratulations to the MuniFin team on a successful USD benchmark transaction, launching their first 3-year USD benchmark in 2024 and second USD benchmark this year. MuniFin secured an efficient funding window this week to ensure they could complete their USD 1 billion funding exercise. The exceptionally high-quality orderbook is a testament to MuniFin’s standing in the fixed income market.”

Read more

MuniFin’s USD 1.5 billion benchmark faced phenomenal demand

Further information

Joakim Holmström

Executive Vice President, Capital Markets and Sustainability

+358 50 4443 638

Antti Kontio

Head of Funding and Sustainability

+358 50 3700 285

Karoliina Kajova

Senior Manager, Funding

+358 50 5767 707

Lari Toppinen

Senior Analyst, Funding

+358 50 4079 300

Aaro Koski

Analyst, Funding

+358 45 1387 465