Municipality Finance (MuniFin) issued on January 14, 2015 a 1 billion USD global benchmark loan to investors. The 5-year fixed rate benchmark loan offering was a 1.5 percent coupon interest rate and a 1.554 percent re-offer yield.

MuniFin last issued a 3-year USD global benchmark in September 2014 with exceptionally strong response from the market. The 5-year transaction this January was considered an optimal fit for the current ALM requirements.

The price was confirmed at mid-swaps +10 basic points, which is the tightest pricing ever recorded for a 5-year benchmark loan. In the current volatile market, MuniFin was happy with the pricing and overwhelming investor support for the transaction.

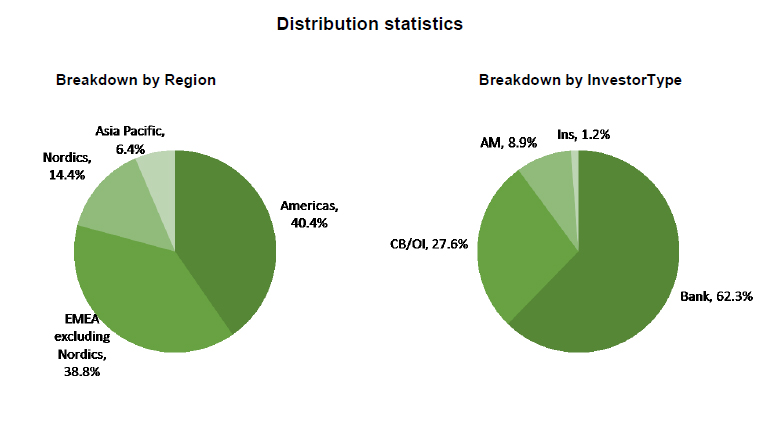

The investor spread was wide both geographically and institutionally, with almost 40 accounts participating. There was a focus on EMEA and Americas investors, and strong support from central banks, official institutions and bank treasuries.

The lead managers of the benchmark were Barclays, J.P. Morgan, Nordea and TD Securities.

Currently all of MuniFin’s lending is funded from the international capital markets. The benchmark loan in January was MuniFin’s 13th transaction in 2015.

Further information:

Esa Kallio, Executive Vice President, Deputy to CEO, tel. + 358 50 3377 953, esa.kallio@munifin.fi

Joakim Holmström, Vice President, Head of Funding, tel +358 9 50 444 3638, joakim.holmstrom@munifin.fi