The sanctions imposed on Russia by Western countries and Russia’s countermeasures affected international trade and increased the price of both energy and raw materials. Cost pressures also further accelerated inflation, which had already been increasing in the previous year. Confidence in the economy was badly shaken by the combined effect of the war, the rising cost of living and energy-related concerns.

Further tumult was created by the sharp U-turn in monetary policy. Central banks had been underestimating the risks associated with persistent inflation even before the Russian invasion, so when the monetary policy was finally and belatedly tightened, it had to be done fast and in exceptionally large steps.

Positively surprising economic resilience

Despite the sharp turns in the operating environment, the development of GDP was a positive surprise in 2022. The euro area saw relatively stable growth, and thanks to an unexpectedly strong early first half, Finland’s GDP growth remained positive until the third quarter.

The stronger-than-expected economic development stemmed from several different factors. The bottlenecks in production and supply chains, which severely disrupted goods trade last year, largely cleared during 2022. The service sector also started to revitalise after the COVID restrictions were lifted. Many households accumulated extra savings during the COVID period, which has helped them cope with the rapidly rising cost of living to some extent. The business sector seems to have adapted to the European energy crisis better than expected.

Recession projected to remain mild, but risks are growing

Despite the positive observations above, the growth outlook clearly weakened in all main economic areas this autumn. Finland is likely to have already entered a recession due to the threefold trouble households have with food, energy and housing costs, which are all rising quickly and eroding consumers’ purchasing power and bringing down private consumption. The rapid increase in interest rates is slowing down investments and cooling down the housing market. Residential property prices have already turned to a noticeable decline.

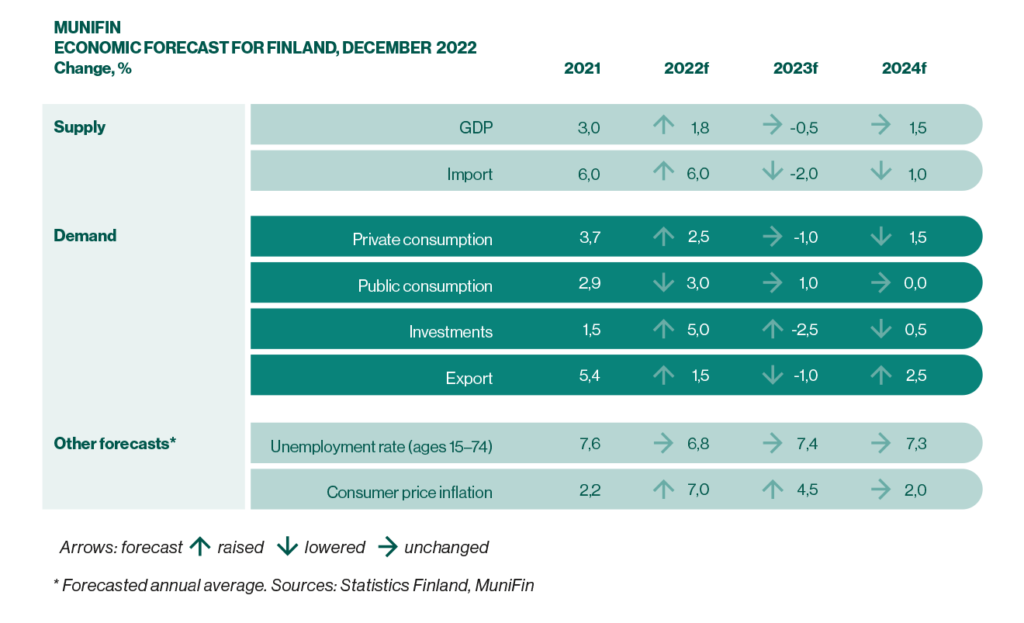

Thanks to Finland’s robust industry and high employment, MuniFin still estimates that this period of economic recession will be relatively mild and short-lived. We maintain our GDP forecast for the next few years unchanged, at -0.5% for 2023 and 1.5% for 2024. We revised our GDP forecast for the current year slightly, raising it to 1.8% due to the unexpectedly strong economic development.

It should be noted, however, that the above-mentioned scenario of mild recession involves considerable risks. Consumers’ savings will shrink and the negative effects of the rising cost of living may begin to accumulate during the next year. Moreover, the simultaneous cooling of the economic cycles in Europe, the United States and China may weaken exports more than expected.

Sharply rising interest rates also pose a significant risk to future economic development, and they have not yet had their full effect on all debtors. Many households have their interest rate review dates in the first half of 2023 and will not face the substantially rising loan servicing costs until next winter and spring.

High employment steadies the outlook

For now, employers seem to be looking beyond the temporary recession, aiming to retain skilled workforce. Layoffs return on the agenda if the economic stagnation becomes worse than expected in the winter, but large-scale unemployment is still a long way from the severe labour shortage currently occurring in Finland.

It is to be expected that the contracting economic cycle will eventually also affect the labour market to some extent: employment growth will halt and the unemployment rate will turn to a moderate rise. MuniFin still expects unemployment to rise moderately to 7.4% next year and to remain at approximately the same level (7.3%) in 2024.

Interest rates will continue to rise in early 2023

The strongest rise in consumer prices is already calming down, but it may take a couple of years for inflation to slow down to the target level of the central banks. Interest rate hikes will presumably continue at least through the first half of 2023, with other ways of tightening monetary policy lasting much longer. Key interest rate is expected to rise to around 5% in the United States and to around 2.5–3% in the euro area.

Inflation peak soon passed

In Finland, inflation reached its highest level in almost 40 years in 2022, but nevertheless remained below the euro area average. Energy prices have affected inflation somewhat less in Finland than in Central Europe, and long contract periods might also factor into this as they react to cost pressures with a delay. The flipside to this is that inflation may also fall more slowly in Finland than in the euro area.

MuniFin revised its inflation forecast for the current year to 7.0%. The inflation peak will probably occur at the end of 2022, but inflation will remain at an exceptionally high level also next year. In 2023, we expect consumer prices to rise at an average rate of 4.5%, and in 2024 we expect inflation to finally decrease to 2%.

The year 2023 is an opportunity for municipalities to make their economy more sustainable

Finland’s health and social services reform will change Finnish municipal sector fundamentally. It will halve the volume of municipal operations and shake up the structure of income and expenses. But municipalities will not bear the full force of these changes next year as they will be soothed by a one-time tax benefit of more than one billion euros, stemming from the tax cuts introduced by the reform and implemented fully only in 2024.

Thanks to this temporary tax benefit, municipalities will be in a stronger position in 2023 than ever before in the 2000s, even though the increase in salary and interest expenses and the acceleration of overall inflation will take a toll on municipal sector as well. This will offer municipalities some breathing space next year, which they would be wise to spend on securing their financial sustainability in the long term.

One of the reform’s financial effects is the heightened significance of capital expenditure: the needs for municipal investments will not drop nearly as much as operating expenses. At the same time, depreciation will play a greater role in the municipal cost structure. After the reform, it will be even more important for municipalities to ensure their investment capacity.

Municipalities should not be fooled by the temporarily strong financial figures of 2023. Instead, they should pay even more attention to securing sufficient income now that interest rates have risen considerably and made loan servicing costs a significant cost item again.

The gap between financially strong municipalities and those in deficit will widen

The health and social services reform is widening the financial gap between municipalities, giving financially strong municipalities more room to manoeuvre while putting municipalities that are in deficit in an even more difficult position.

It is especially important for municipalities in structural deficit to try to find solutions to their situation. As a general rule, the reform will not significantly change the municipalities’ financial balance in terms of euros, but imbalances may grow markedly in relation to the size of the operational economy. Municipalities will have a much more limited scope for adjusting their operations in the future.

In some municipalities, the need to improve the cost-effectiveness of core operations can prove so great that it may well speed up cooperation between municipalities and eventually also result in municipal mergers. Severe financial deficit is relatively more common in small municipalities with less than 5,000 inhabitants than in large and medium-sized municipalities.

Finnish municipalities will also have to prepare for the possibility that a severely imbalanced central government finances may reflect on state transfers in the coming years. Even though the rising costs of health and social services will be removed from municipalities, the financing gap of the wellbeing services counties will pose an indirect threat to municipal finances as well.

Additional information:

Timo Vesala, Chief Economist

timo.vesala@kuntarahoitus.fi

tel. +358 50 5320 702

Soili Helminen, Communications Manager

ext-soili.helminen@kuntarahoitus.fi

tel. +358 400 204 853