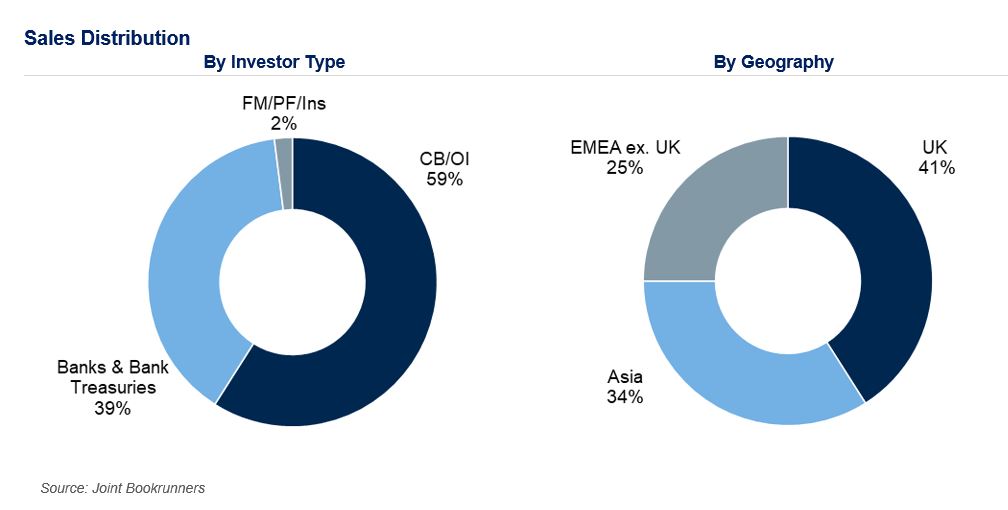

Distribution of the transaction was once again broad both in terms of investor types and geographics, which is testament to MuniFin’s strong position in the global investor community.

Central banks and official institutions were the largest investor component, taking 59% of the final book. The participation was also strong from banks and bank treasuries (39%), with fund managers, pension funds and insurance accounts representing 2%. In terms of geography, the transaction was broadly diversified across UK (41%), Asia (34%) and EMEA ex. UK (25%) investors.

“This was our first GBP line of the year, and it was great to extend our GBP issuance curve today. We are grateful for the investor following we have in the Sterling market and it has been a pleasure to be able to be on the screens again”, says Senior Manager Karoliina Kajova from MuniFin’s funding and sustainability team.

Transaction details

| Issuer: | Municipality Finance Plc (“Munifin”) |

| Ratings: | Aa1 / AA+ (both Stable) by Moody’s / S&P |

| Format: | Senior, Unsecured, Reg S, Registered |

| Coupon: | 4.375% Fixed, Annual, ACT/ACT ICMA, short first |

| Size: | GBP250 million |

| Pricing Date: | 29th February 2024 |

| Payment Date: | 7th March 2024 (T+5) |

| Maturity Date: | 2nd October 2028 |

| Reoffer Spread: | SONIA MS + 30 bps | UKT Oct-28 + 29.6bps |

| Joint Bookrunners: | J.P. Morgan, RBC Capital Markets, TD Securities |

Comments from bookrunners

“Congratulations to the MuniFin team for a strong return to the GBP market, taking advantage of a clear issuance window to extend their GBP curve with a new benchmark. The strong support from a diverse group of investors and the competitive price point is a testament to MuniFin’s standing in the international market. We’re delighted to be involved!”

Tina Nguyen, Vice President, SSA DCM, J.P. Morgan

“Congratulations to the MuniFin team on the new GBP Oct-28 Benchmark. Taking advantage of a clear issuance window, MuniFin were able to extend their GBP Benchmark curve and maintain their regular presence in the Sterling SSA market. RBC were delighted to be a part of the transaction.”

James Taunton, Director, SSA DCM, RBC Capital Markets

“We are delighted to be involved in MuniFin’s successful return to the Sterling market with their first GBP Benchmark of the year. This syndication is a clear demonstration of their global support from a diversified investor base. Congratulations to the MuniFin team on an excellent trade.”

Paul Eustace, Managing Director, Global Co-Head of SSA and Head of Europe and Asia Syndicate, TD Securities

Further information

Joakim Holmström

Executive Vice President, Capital Markets and Sustainability

+358 50 4443 638

Antti Kontio

Head of Funding and Sustainability

+358 50 3700 285

Karoliina Kajova

Senior Manager, Funding

+358 50 5767 707

Lari Toppinen

Senior Analyst, Funding

+358 50 4079 300

Aaro Koski

Analyst, Funding

+358 45 1387 465