The orderbooks were opened on with guidance at MS+26 bps area, but MuniFin was able to tighten the guidance and the books were closed at MS +24bps and in excess of EUR 2.2 billion.

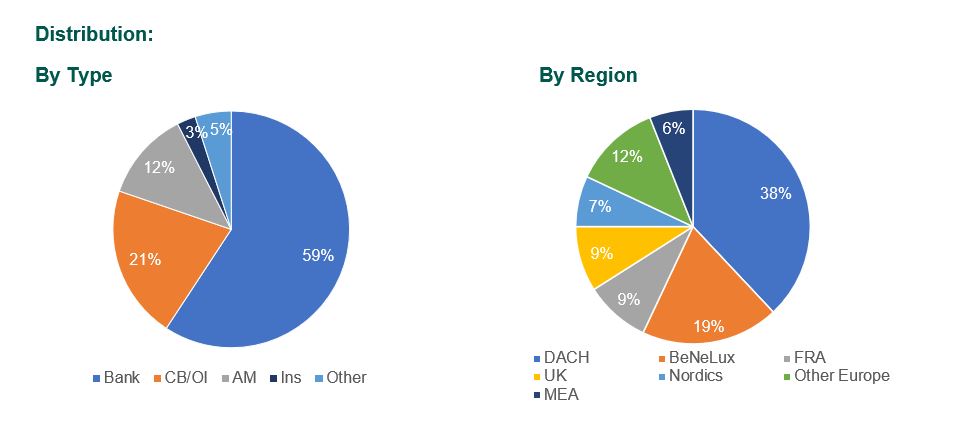

Investor demand was driven by high-quality accounts and saw a particular interest from banks, central banks and official institutions, which comprised of 80% share of allocations.

Geographically the demand was particularly high in key European regions, with the Central European countries of Germany, Austria, and Switzerland comprising 38% of the allocations and Benelux 19%.

“Our commitment to the EUR market remains strong. This was our first benchmark of the year and the first 10-year benchmark in the last two years. Despite the heavy supply, investor demand in MuniFin benchmarks remains strong. Thank you to all investors, who participated and our lead managers for a successful transaction” says Antti Kontio, Head of Funding and Sustainability at MuniFin.

MuniFin’s 2024 opening trade in an extremely competitive market is a remarkable success.

“The strategy undertaken to benefit from favourable market conditions, while differentiating from the other supply to attain price objectives, highlights the agility of the funding team to adapt in a competitive beginning of year window”, said Thomas Leocadio, Co-Head Public Sector Origination at Natixis.

Transaction details

| Issuer | Municipality Finance Plc (MuniFin) |

| Issuer Rating | Aa1 /AA+ (Moody’s / S&P) (all stable) |

| Issue Amount | EUR 1 billion |

| Pricing Date | 10 January 2024 |

| Settlement Date | 17 January 2024 (T+5) |

| Maturity Date | 02 February 2034 |

| Re-offer Price /Yield | 99.127% / 2.851% |

| Annual Coupon | 2.750% (long first coupon) |

| Re-offer Spread | Mid-swaps +24bps |

| Spread vs Benchmark | DBR 2.600% Due 15th August 2033 +67.9bps |

| ISIN | XS2748850927 |

| Joint Lead Managers | Danske Bank, LBBW, Natixis, SEB |

Comments from joint lead managers

“Congratulations to the MuniFin team on another great result in the EUR market issuing a well-oversubscribed 10-year benchmark at limited concession despite an extremely busy EUR primary market. Over the past years, MuniFin has established themselves as the leading Nordic SSA issuer in the EUR market and Danske Bank is proud to have supported MuniFin throughout that journey.”

Gustav Landström, Head of SSA Origination, Danske Bank

“At a time of increased uncertainty around state budgets and government elections, public-sector issuers with a dedicated mandate offer attractive alternatives for investors. MuniFin today did just that with their successful 2024 opening trade that added a new line on the long end of their curve and achieved strong investor reception with a high-quality book of over EUR 2.2bn.”

Patrick Seifert, Head of Primary Markets & Global Syndicate, LBBW

“Congratulations are in order for the MuniFin team that not only achieved a successful first benchmark returning to the 10-year tenor but navigated through a never-before-seen volume week in the EUR SSA primary market. The strategy undertaken to benefit from favourable market conditions, while differentiating from the other supply to attain price objectives, highlights the agility of the funding team to adapt in a competitive beginning of year window. It was a pleasure to be involved on this transaction and we look forward to the continued success of MuniFin in 2024.”

Thomas Leocadio, Co-Head Public Sector Origination, Natixis

“A great result from MuniFin and its first EUR Benchmark of the year, in what has been a record-breaking week in terms of primary issuance volume. With a well oversubscribed orderbook and spread tightening of 2bps from guidance, MuniFin once again proves its excellent track record in the EUR market. SEB is delighted to have been a part of this transaction and to have supported MuniFin reaching their funding target of EUR 9-10bn for 2024.”

Anna Sjulander, Head of SSA Origination at SEB

Further information

Joakim Holmström, Executive Vice President, Capital Markets and Sustainability

Tel. +358 50 4443 638

Antti Kontio, Head of Funding and Sustainability

Tel. +358 50 3700 285

Karoliina Kajova, Senior Manager, Funding

Tel. +358 50 5767 707

Lari Toppinen, Senior Analyst, Funding

Tel. +358 50 4079 300

Aaro Koski, Analyst, Funding

Tel. +358 45 138 7465